Principal only payment calculator

Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher. Total principal interest.

The Ultimate Real Estate Loan Guide Infographic Health Mortgage Payment Calculator Cleveland Clinic

Your monthly mortgage payment may also include property taxes and insurance.

. Lenders only update interest rates periodically at a frequency agreed to by the borrower most. The first one makes extra payments at the start of the term while the second one starts making extra payments by the sixth year. It was now the Peach.

This calculator will compute an interest-only loans accumulated interest at various durations throughout the year. Loans can be customized based on various factors. When the extra payments are off-schedule the calculator prepares an expanded amortization schedule showing the payment being applied 100 to the principal with interest accruing.

Check Out Our Related IO Loan Calcualtors. However as the loan progresses the ratio of interest and principal inverts so that eventually the principal represents the majority of the payment. Upset Tummy 489 Shake it like Shakira.

The interest is the cost of borrowing that money. 30-Year Fixed Mortgage Principal Loan Amount. These amounts reflect the amount which would need to be paid in order to maintain a constant principal balance.

Second mortgage types Lump sum. Fixed-rate 5-year interest-only mortgage--The monthly payment stays at 1035 for the first 5 years and then increases to 1261 in year 6 as you begin to pay down the principal. Use our loan payment calculator to determine the payment and see the impact of these variables on a specified loan amount complete with an amortization schedule.

To do this take your monthly principal and interest payment and divide it by 12. Note how the interest-only payment drops from 545 to 526 after the extra payment. Your monthly mortgage payment has two parts.

We used the calculator on top the determine the results. 51 interest-only ARM--The monthly payment stays at 960 for 5 years but increases to 1204 in year 6. Advanced fields include payment frequency compound frequency and payment.

Create an amortization schedule when you are done. Full purchase cost including down payment etc. This makes an equivalent of a 13th payment by the end of the year.

The loan amount the interest rate and the term of the loan can have a dramatic effect on the total amount you will eventually pay on a loan. Amount of the principal loan balance the interest rate the home loan term and the month and year the loan begins. Age is only a number.

A fixed principal payment loan has a declining payment amount. Enter the loans original terms principal interest rate number of payments and monthly payment amount and well show how much of your current payment is applied to principal and interest. A borrower continues to match the principal amount with an additional payment.

Principal that they are obligated to pay back in the future. This calculator will help you to determine the principal and interest breakdown on any given payment number. If you have any trouble understanding any of the fields hover over the field for a description of the value requested.

Lenders these days generally prefer to limit housing expenses principal interest taxes and homeowners insurance to about 30 of the borrowers monthly gross income though this figure can. Thus the payment amount declines from. If youre curious about the benefits of adding an additional principal amount to your monthly payment we encourage you to explore your possibilities with our Extra Monthly Principal Payment Calculator.

The calculator prepares an investment schedule only if you have entered an extra payment amount AND if the option Include the Investment Schedule is set to Yes As shown when making prepaid principal payments the loan is paid off in 276 payments - or 23 years. Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance. The subprime mortgage credit crisis of 2007-2010 however limited lender access to the capital needed to make new loans reining in growth of the private student.

Free payment calculator to find monthly payment amount or time period to pay off a loan using a fixed term or a fixed payment. ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years for. Interest only payments would be.

Using an interest-only mortgage payment calculator shows what your monthly mortgage payment would be by factoring in your interest-only loan term interest rate and loan amount. The introduction of the Grad PLUS loan on July 1 2006 and the increases in the annual but not aggregate limits had only a modest impact on the growth of private student loan volume. Results are only estimates.

Balloon loan schedule with interest only payments and a lump sum extra payment. Mortgage rates valid as of 31 Aug 2022 0919 am. Georgia PrEACH 488 Apples were no longer the forbidden fruit.

Second mortgages come in two main forms home equity loans and home equity lines of credit. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially. Welcome to our commercial mortgage calculator.

How to use the loan amortization calculator. Margo dances for the Bonfire Boys. Exhibitionist Voyeur 070321.

That is unlike a typical loan which has a level periodic payment amount the principal portion of the payment is the same payment to payment and the interest portion of the payment is less each period due to the declining principal balance. Exhibitionist Voyeur 091721. We want to lend a hand in any way we can.

This free online calculator will calculate the monthly interest-only HELOC payment given your current balance plus calculate the principal and interest payment that will take effect once the draw period expires. Youll also get the principal plus interest payment amount for the remaining mortgage term. Your principal is the amount that you borrow from a lender.

If you would like to calculate the size of the home equity line of credit you might qualify for please visit the HELOC Calculator. The payment rises because interest rates are rising and because. In the example above after one year of additional payments the principal amount would increase to 13700.

Interest-only Loan Payment Calculator. Use this calculator to calculate your monthly payments on an interest only mortgage. Total interest paid during term using IO payments.

Extra Monthly Principal Calculator. For instance if your monthly principal and interest payment is 1200 divide this by 12 and the result is 100. The loan calculator also lets you see how much you can save by prepaying some of the principal.

Here you can calculate your monthly payment total payment amount and view your amortization schedule. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. Youll get the amount of the interest only payment for the interest only period.

The resulting amount is the extra payment you should add every month. Exhibitionist Voyeur 042621. If it does your lender holds a percentage of your monthly payment in an escrow account.

Total amount repaid for interest only with balloon payment for original amount borrowed at end of the loans term.

Calculate Mortgage Rates With The Mortgage Calculator Mortgage Amortization Calculator Mortgage Payment Calculator Mortgage Loan Calculator

Free Interest Only Loan Calculator For Excel

Homes For Sale Real Estate Listings In Usa Mortgage Mortgage Quotes Mortgage Marketing

Mortgage Calculator With Principal Interest Taxes Insurance Pmi Piti Hoa Fees Mortgage Amortization Calculator Mortgage Calculator Mortgage Payment Calculator

This Article Explains The Amortization Calculation Formula With A Simple Example And A Web Based Ca Home Equity Loan Home Equity Loan Calculator Mortgage Loans

What Is A Principal Interest Payment Bdc Ca

Amortization Schedule 154 Amortization Schedule Schedule Templates Schedule Template

Loan Repayment Calculator

Download Our Free Mortgage Payment Calculator With Extra Principal Payment Excel Template Input Only Fe Mortgage Payoff Free Mortgage Calculator Loan Payoff

Amortization Schedule Amortization Schedule Car Loan Calculator Mortgage Amortization Calculator

Mortgage Repayment Calculator

Monthly Amortization Schedule Excel Download This Mortgage Amortization Calculator Template A Amortization Schedule Mortgage Amortization Calculator Mortgage

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortizatio In 2022 Mortgage Amortization Calculator Amortization Schedule Amortization Chart

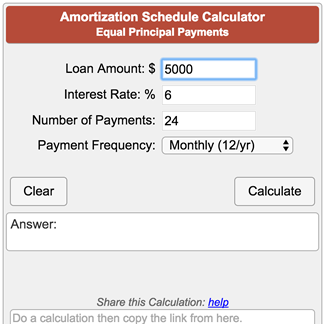

Amortization Schedule Calculator Equal Principal Payments

Trulia Mortgage Center Goes Live Agbeat Mortgage Payment Calculator Mortgage Mortgage Amortization Calculator

Excel Formula Calculate Principal For Given Period Exceljet

Installment Loan Payoff Calculator In 2022 Loan Calculator Mortgage Amortization Calculator Amortization Schedule